Loan in 59 Minutes

Loan in 59

Minutes

Loan in 59 Minutes-Initiative

simplifies the process of fundraising to individuals & MSMEs

Introduction

This scheme offers a user-friendly platform to ease finance to borrowers so that they can focus on business expansion and on other business operations.

Aim

1. To automate & digitalize the process of the loan.

2. Applicants can get loans ranging from Rs.1 Lakh to Rs.10 Crore

3. Approvals are sent within 59 minutes

MSME

Loans

This sector

plays an important role in the social and economic development of India.

The economy’s

growth depends on its MSMEs (Micro, Small, & Medium Enterprises). MSME

sector is responsible for providing employment to millions of people. This

sector is also known as India’s engine of growth. Adequate & timely finance

is one of the challenges faced by this sector.

This scheme

aim to transform business lending process convenient, simple & easy.

Maximum limit of a 59 minutes loan

|

Types

of loan |

Maximum

Amount |

|

Business

loan |

INR 1

lac to INR 5 crore |

|

Mudra

loan |

INR 10

lakh |

Business

Loan

2. Working Capital loan – Financing that ensures smooth operations.

3. Mudra loan – Finance to non-farming & noncorporate micro & small enterprises.

Benefits

1. The entire process is quick and

requires minimum documentation.

2. Apply anywhere anytime

3. Easy to understand

4. psbloanin59min.com is a user-friendly

platform.

5. The process is fast and hassle-free.

6. No human bias

7. Transparent terms

8. Technology backed eligibility check

9. Real-time processing

10. Best user experience

Eligibility

& documentation

To apply

online keep all the documents ready in the required format

1. GST registered business

2. ITR for a minimum of 1 year in XML format

3. Bank statement for last 6 months in pdf form

4. Other business details – To cater to the requirement of Non-GST

business, some business details have to

be filled manually.

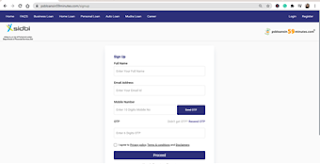

How to apply for a 59-minute loan for MSME?

1. Go to

official website- https://www.psbloansin59minutes.com/home

2. Fill this

form and proceed

Partner

Banks

Comments

Post a Comment